Life insurance is a crucial financial tool that provides protection and peace of mind for individuals and their families. It offers a financial safety net in the event of the policyholder’s death, ensuring that their loved ones are taken care of financially. In this article, we will delve into the details of life insurance, its types, benefits, and factors to consider when purchasing a policy.

What is Life Insurance?

Life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays regular premiums, and in return, the insurance company provides a lump sum payment, known as the death benefit, to the policyholder’s beneficiaries upon their death. This financial payout can be used to cover funeral expenses, pay off debts, replace lost income, or provide for the future needs of the policyholder’s dependents.

Contents

Types of Life Insurance

There are several types of life insurance policies available, each designed to meet different needs:

1. Term Life Insurance

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a death benefit if the policyholder passes away during the term. This type of insurance is often more affordable than other options, making it a popular choice for those seeking temporary coverage.

2. Whole Life Insurance

Whole life insurance provides coverage for the entire lifetime of the policyholder. It combines a death benefit with a cash value component that accumulates over time. Premiums for whole life insurance are generally higher than term life insurance but remain level throughout the policyholder’s life.

3. Universal Life Insurance

Universal life insurance offers flexibility in terms of premium payments and death benefits. It allows policyholders to adjust their coverage and premiums as their financial situation changes. Universal life insurance also includes a cash value component that can grow over time.

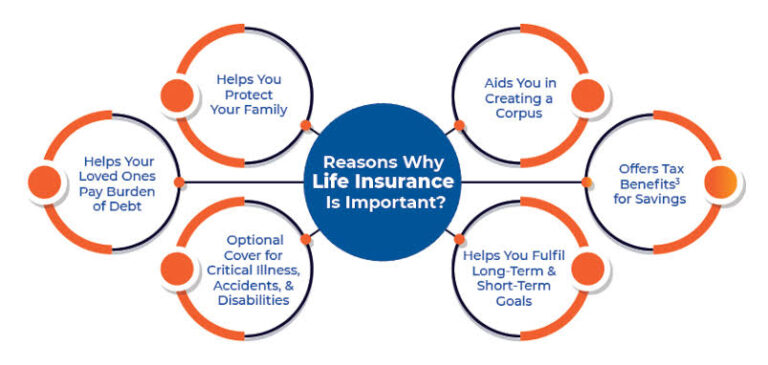

Benefits of Life Insurance

Life insurance offers numerous benefits for individuals and their families:

1. Financial Protection

The primary benefit of life insurance is the financial protection it provides to the policyholder’s beneficiaries. The death benefit can help cover immediate expenses, such as funeral costs, outstanding debts, and daily living expenses. It ensures that loved ones are not burdened with financial hardships during an already difficult time.

2. Income Replacement

If the policyholder is the primary breadwinner, life insurance can replace lost income for their dependents. It ensures that the family’s financial obligations, such as mortgage payments, educational expenses, and other bills, can still be met even after the policyholder’s passing.

3. Estate Planning

Life insurance can play a vital role in estate planning. It can help cover estate taxes, ensuring that the policyholder’s assets are passed on to their beneficiaries without any financial strain. It can also provide liquidity to the estate, allowing for the smooth transfer of assets.

4. Business Continuation

For business owners, life insurance can help ensure the continuity of their business in the event of their death. It can provide funds to buy out the deceased owner’s share, settle outstanding debts, or hire a replacement.

Factors to Consider When Purchasing Life Insurance

When purchasing life insurance, there are several factors to consider:

1. Coverage Amount

Determine the amount of coverage needed to meet your financial obligations and provide for your loved ones adequately. Consider factors such as outstanding debts, future expenses, and income replacement needs.

2. Premium Affordability

Choose a policy with premiums that fit comfortably within your budget. Remember that life insurance is a long-term commitment, so it’s essential to select a policy that you can afford over the years.

3. Policy Riders

Policy riders are additional features that can be added to a life insurance policy to enhance its coverage. Examples include accelerated death benefit riders, which allow policyholders to access a portion of the death benefit if diagnosed with a terminal illness.

4. Insurance Company Reputation

Research the reputation and financial stability of the insurance company before purchasing a policy. Look for companies with a strong track record of customer satisfaction and timely claim settlements.

5. Review and Update Regularly

Life insurance needs can change over time, so it’s important to review your policy periodically. Major life events such as marriage, the birth of a child, or significant financial changes may require adjustments to your coverage.

In conclusion, life insurance is a vital financial tool that provides protection and financial security for individuals and their families. By understanding the types of life insurance available, its benefits, and the factors to consider when purchasing a policy, individuals can make informed decisions to safeguard their loved ones’ future.